Medicare Supplement Loss Ratios Increase to 77%

In 2021, the overall market loss ratio was 77.4%.

This is up from the 2020 loss ratio of 72.4%, but lower than the 2019 loss ratio of 80.4%.

The lower 2020 loss ratio was driven by reduced utilization of elective services during the COVID-19 pandemic.

The lower 2021 loss ratio is also a result of COVID-19 reduced utilization at the beginning of 2021.

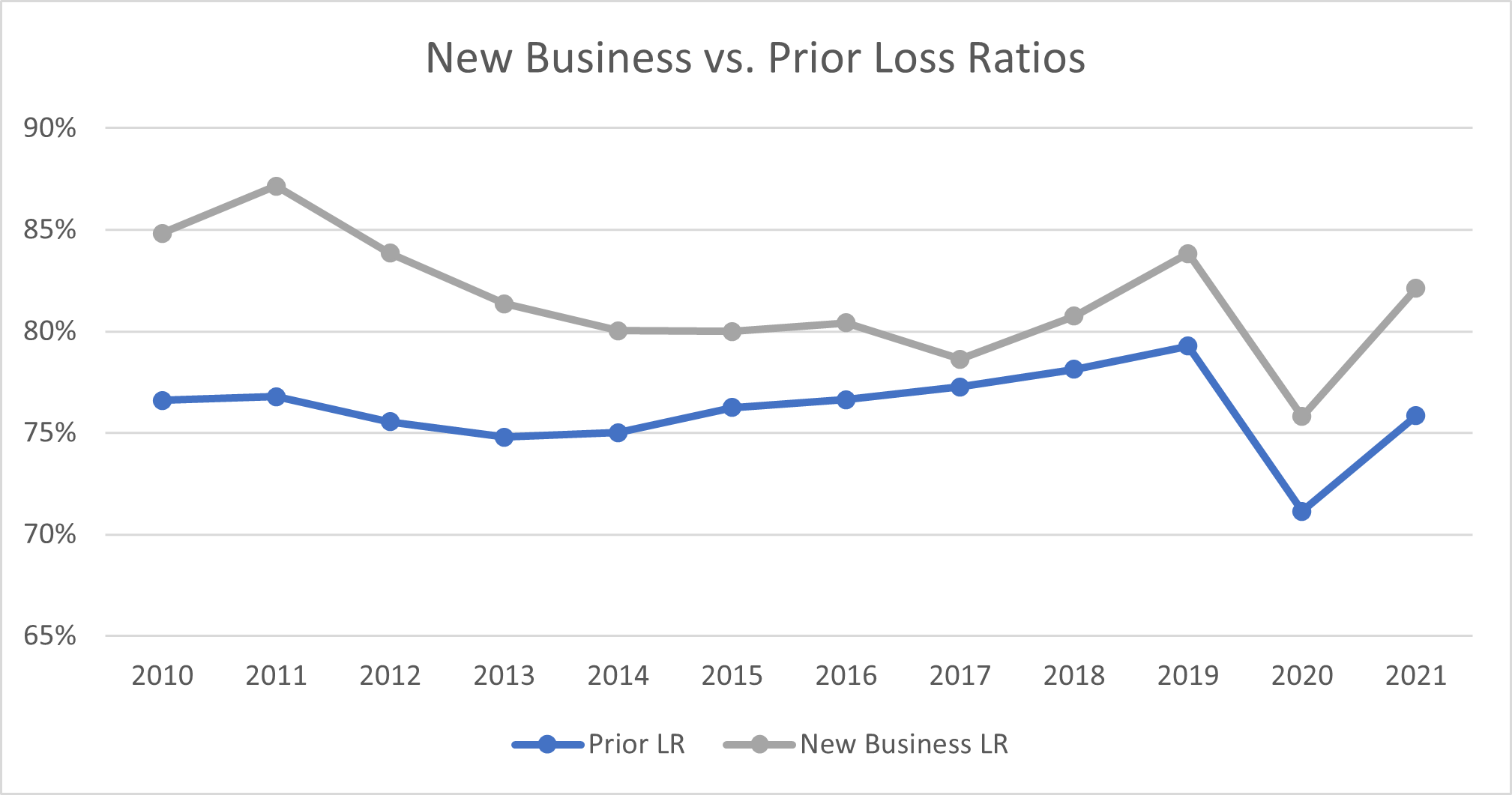

“New Business” loss ratios continue to be higher than “Prior” loss ratios in 2021. The difference between them has increased to 6% (82% vs 76%), which is the largest difference since 2013 when there was a 7% spread.

NOTE: ”New Business” = policies issued in the most recent 3 years; “Prior” = policies issued prior to the most recent 3 years.

Plan G, which is the most popular plan today, continues to have the highest loss ratio among plans F, G and N.

This is likely driven by increased competitive pressure on Plan G, combined with the MACRA 2020 change which resulted in Plan G being the most benefit rich plan (for newly eligible beneficiaries) starting in 2020.

Plan N continues to see lower loss ratios, reflecting the fact that healthier individuals are more likely to pick Plan N due to the cost sharing components.

For more information on the Medicare Supplement market take a look at our previous blog posts here and here.

Next week we will look at how the mix by plan has changed over time.

Source data: National Association of Insurance Commissioners, by permission. The NAIC does not endorse any analysis or conclusions based upon the use of its data.